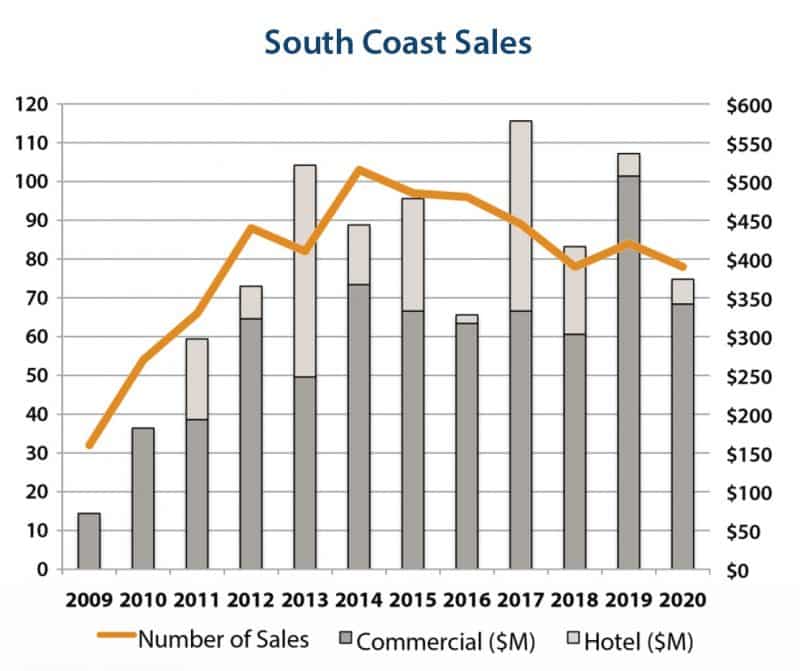

Given the economic headwinds, sales volume was surprisingly robust with 78 sales totaling $342 million (excluding hotel sales) during 2020, with the lion’s share of activity in the second half of the year. The annual transaction count was only 12% shy of the prior 5-year average.

Five high-priced office investment sales produced half of the total commercial dollar volume. This is compelling evidence of durable demand among well-capitalized investors in a position to pursue long-term strategies beyond the pandemic. With stock markets setting new record highs, interest rates near historic lows, and property values undercut by the recession, real estate is an increasingly appealing investment class in the current environment.

Inventory was near the historical peak throughout 2020, ending the year at 75 properties for sale. Despite the elevated supply on the market, 56% of sales were off-market transactions, which is about 10% above the historical trend. This is another indicator of abundant demand, with many properties going under contract before being brought to market.

Owner-user buyers represented 51% of sales, making 2020 the third consecutive year in which owner-users purchased more properties than investors, contrary to the historical pattern. Favorable financing on SBA loans has encouraged this trend, allowing businesses to acquire real estate for their own use. Owner-users also have an advantage in the current climate because more buildings than usual are vacant and are therefore less appealing to investors. However, investors continued to generate the majority of dollar volume in 2020, producing 79% of the dollar consideration.

The 165,462 sf AppFolio campus at 50-90 Castilian Dr in Goleta was sold in an off-market transaction for $60.5M.

Office sales reached an unprecedented dollar volume of $355 million in 2019. The first two quarters of 2020 brought a profound lull in sales, and office inventory for sale expanded to a new high of 26 properties at midyear. Then—despite the pandemic, a major recession, and the fact that most office buildings had almost no one working in them—an unexpected rally emerged in the second half of the year, producing 22 office transactions totaling $203 million, along with a 35% contraction of inventory.

Office property dispositions by Santa Monica-based Montana Avenue Capital resulted in the two largest commercial sales of the year. They sold 50-90 Castilian Dr in Goleta in December after only a year of ownership. Fully leased to Appfolio, the 165,462 sf office campus on 5.3 acres was acquired by a Los Angeles-area joint venture for $60.5 million in an off-market transaction. Aside from hotels, this is the highest price paid for a South Coast commercial asset that we have on record. Montana Avenue also sold 6303-6309 Carpinteria Ave in Carpinteria, a 121,230 sf office property on 9.3 acres, for $44 million. The buyer is a Los Angeles-based investor.

The standout office sale in Santa Barbara was the 48,564 sf office building occupied by Amazon at 1001 State St, which a local investor sold for $36.25 million to Global Mutual, which is headquartered in London and Los Angeles.

Agoura Hills-based Majestic Asset Management also had a busy year, completing six sales in Goleta, including the $20 million acquisition of the 175,000 sf Logmein campus at 7414-7418 Hollister Ave. Majestic also purchased the 57,937 sf building at 120 Cremona Dr for $13.2 million from EastGroup. Both were off-market transactions.

Industrial sales were also unexpectedly active, exceeding the prior 5-year average in both transactions and dollar volume. Majestic sold four buildings at 5511-5571 Ekwill St in Goleta in separate transactions for a total of $14.1 million. Meanwhile, in Santa Barbara 10 industrial properties changed hands, including the 13,000 sf building at 224 S Milpas St, purchased by an owner-user for $5.0 million. However, despite the healthy volume of transactions, industrial inventory remains unusually high at 15 properties for sale, more than double the average of the past five years.

For retail property, 2020 was the slowest sales year since 2014. There were four sales on State Street in downtown Santa Barbara, including most recently 330 State St, which traded for $6.3 million. As of year-end, there were 31 retail properties for sale on the South Coast, a record high.

Looking at prices, average cap rates compressed only 30 basis points compared to 2019, with the caveat that the comparison is based on a limited data set. The average price per square foot for office and retail decreased 10% and 20%, respectively, while industrial increased 5% and land remained level, compared to 5-year averages.

We head into 2021 having just witnessed one of the most active six-month periods for commercial sales in the past 10 years, which gives the market considerable momentum. The unusually large inventory of property for sale makes it a buyer’s market, although price discounts granted by sellers will likely vary by property type. Given all the challenges surrounding State Street, it is worth noting that there were 13 sales on or within two blocks of State Street’s downtown corridor, several of which were purchased with visions for development or adaptive repurposing intended to have a positive effect on downtown Santa Barbara.