Work and business spaces are shifting in response to the COVID-19 pandemic

[Excerpts of the article follow. See the full text at the link above.]

Coronavirus is changing how and where we do business; working from home may become more the norm for some, and how is State Street faring in this economic storm? These were some of the topics the guests at the recent EFP Informs webinar grappled with, as they focused on rapid changes in the commercial real estate world.

“Before the pandemic started most economists just kind of sat in their chair for a month until new data came out for the quarter,” said Peter Rupert, UC Santa Barbara economics professor and director of the Economic Forecast Project, which produces the webinar series. “Now you’re just bombarded with data.”

And it’s all over the place, too. Stocks dropped like a rock last month in the wake of a record-setting 32.9% drop in GDP for the second quarter; now they’re gaining steam again, due in part to hope for a coronavirus vaccine.

Commercial real estate took a hard hit at the onset of the pandemic, and recovery is at a crawl but looking up said Chris Ludeman, from his vantage point as global president of CBRE, the world’s largest commercial real estate services company. Business fell precipitously by the third week of March, amid widespread stay-at-home orders and uncertainty about the future.

“The market is starting to get much more active now,” he said. “The major money center banks have largely been pencils down on debt, although we’re starting to see signs that they’re about ready to come back into the market.”

The $2.2 trillion CARES Act — the economic stimulus bill passed by Congress in March — helped many commercial tenants stay on top of rent, Ludeman continued, particularly those leasing office, and multifamily spaces.

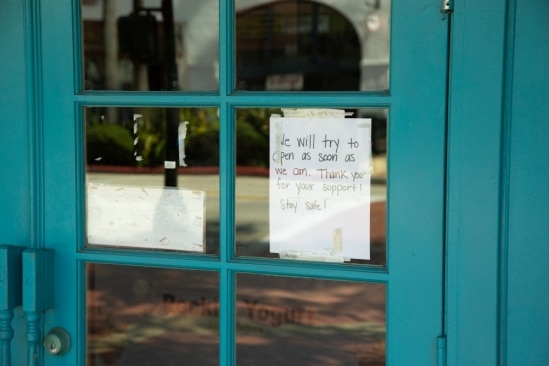

At the other end of the continuum, higher density operations, such as retail and hospitality continue to struggle, as proprietors cope with social distancing measures and pandemic-driven uncertainties.

The sudden pivot to working from home has caused companies and workers to reconsider their office space needs, said Francois DeJohn, founder of Hayes Commercial Group.

“I’m starting to see, for want of a better word, some cracks,” he said. “There are people starting to make decisions on how much space they really need; are they going to be coming back? Can they operate in less space?” One major lessee in Goleta is expected to announce the closure of their offices for good and let go of 80,000 square feet of office space, he said.

Still, while there will likely be more flexibility between working from home and working in an office, but probably not a dramatic shift away from going to the office, DeJohn predicted.

“We were looking at office spaces as a way to attract and retain the best talent,” he said. “Those things don’t go away. It’s hard to build a culture remotely.”

Uncertainty still clouds the future, as people wait on a potential second federal stimulus package, grapple with unemployment, and hope for a coronavirus cure or vaccine.

Meanwhile, the pandemic will continue to drive decisions about real estate, both commercial and residential (more on that in an upcoming webinar). Hotels, particularly the large convention spaces and luxury destinations, are in dire straits, while smaller hotel operations seem to be squeaking by. Retail spaces may convert into office spaces, said the panelists, and office spaces may change to make it easier to conform to social distancing rules and other coronavirus safety measures.