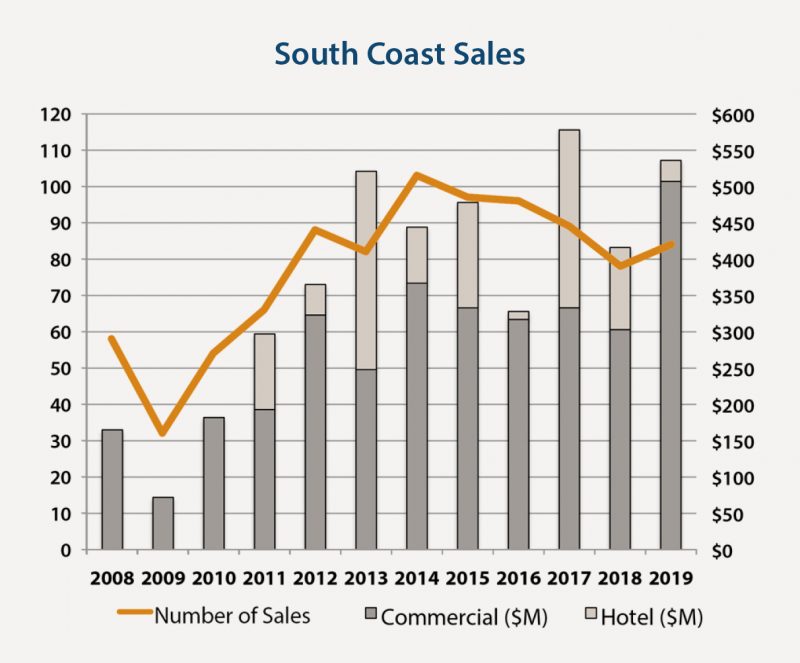

The South Coast commercial sales market soared into uncharted territory in 2019, as dollar volume (excluding hotel property) exceeded $500 million, surpassing the next highest annual total by $140 million. The bulk of the volume proceeded from the office sector, particularly in Goleta, where the stars aligned to produce a series of high-priced sales. The ongoing trend of greater owner-user activity in the market reached a new level, while investor demand for acquisitions in the small and medium price range was tepid.

Office property dominated commercial sales, representing half of the transactions and more than 70% of the dollar volume. There were 12 office sales over $10 million, surpassing the combined total for the four prior years. Surprisingly, the buyers in these high-value transactions were split evenly between investors and owner-users. On the investor side, in the fourth quarter Montana Avenue Capital Partners (MAC) purchase of the 165,000 SF AppFolio campus at 50-90 Castilian Dr for $35.7 million. Also in Goleta, Majestic Asset Management purchased adjacent office/R&D buildings at 125 & 175 Cremona Dr totaling 133,000 SF – long occupied by medical device companies Medtronic and Karl Storz – for $24.2 million. Though based in points south, MAC and Majestic are already well-established owner/operators on the South Coast. As for owner-user sales, on the last day of the third quarter LinkedIn bought the 87,000 SF campus that it has occupied for the past decade at 6410-6460 Via Real in Carpinteria for $30.4 million. Subsequently, the City of Goleta purchased 130 Cremona Dr, the 39,700 SF city hall building it has leased since 2006, for $11.5 million. Nearby, an unnamed tech company purchased the 60,000 SF office/R&D building at 301 Mentor Dr for $23.6 million. To have all of these sales closing over the course of three months is unheard of for the South Coast, and will in all likelihood not be repeated.

All told, owner-users represented 63% of sales transactions and 47% of dollar volume, both unprecedented values. This reflects more caution among investors as well as increased demand among owner-users. Given the bevy of high-priced investor sales, it’s hard to claim that investors are hiding under a rock. However, demand from investors for small to medium sized properties is far lower today than three to five years ago. Demand from owner-users of all sizes is surging, as demonstrated by 2019 purchases by users of all stripes, including corner markets, plumbers, dance studios, doctors, and more than one Fortune 100 company.

AppFolio occupies the 165,000 SF campus at 50-90 Castilian Dr in Goleta,

purchased for $35.7 million by Montana Avenue Capital Partners.

Retail sales were relatively subdued with just 14 transactions completed for the second straight year. Seventy percent of the dollar volume came in two institutional-scale investment sales: the December purchase of the Whole Foods building at 3761 State St by a Los Angeles-based investor for $43.8 million, and the purchase of the 58,762 SF retail and office building at 827-831 State St in August for $23.5 million. The latter was one of three retail buildings sold on State Street downtown; however, there are still nine retail properties for sale along the beleaguered corridor, averaging 440 days on the market.

For sales of industrial property, Santa Barbara’s Laguna District/Lower Eastside area remains the hottest area on the South Coast, producing 37 commercial sales valued at $81.9 million over the past 36 months. Most of those properties had either industrial improvements or undeveloped land with industrial zoning. (By comparison, the Funk Zone has seen just four sales totaling $16.5 million over the past 36 months.) In December, Hayward Lumber bought two industrial properties on Laguna Street totaling $4.7 million as part of its acquisition of Buena Tool.

For 2020, market conditions remain in place to promote strong sales activity, though a repeat of the $500 million year is extremely unlikely. There are 63 properties for sale, providing ample supply, especially in the retail category. The market has stabilized to a phase of active but cautious investors and very high demand from owner-users. In 2019, 45% of transactions were off-market, a historically high ratio that confirms robust underlying demand. Several recent high-value sales have been prominent, locally-based owners selling to investors from out of the area, such as MAC and Majestic mentioned above. It bodes well for our market that buyers from other areas increasingly want to invest in and/or develop property on the South Coast.